Jaguar Mining Inc. ("Jaguar") (JAG - TSX), reports additional significant gold grades and widths from its on-going exploration program at the Turmalina project in Minas Gerais, Brazil. Based on the new information, Jaguar is optimistic that it will be able to substantially increase its known Turmalina reserves of 370,000 oz of non-refractory gold contained in 1.9 million tonnes of proven and probable reserves grading 6.0 g/t. Turmalina begins production this fourth quarter.

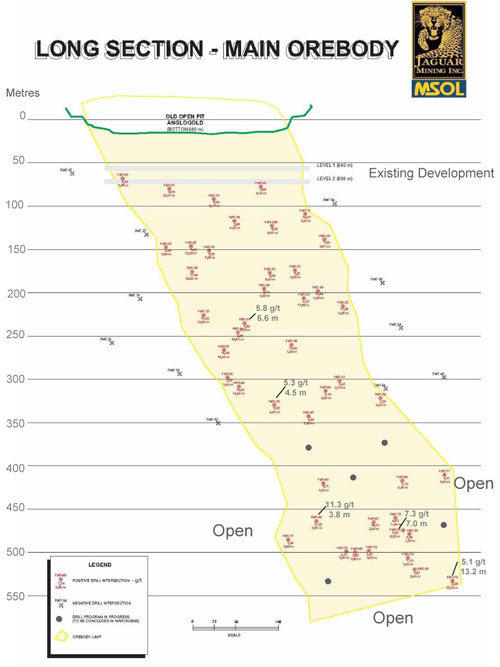

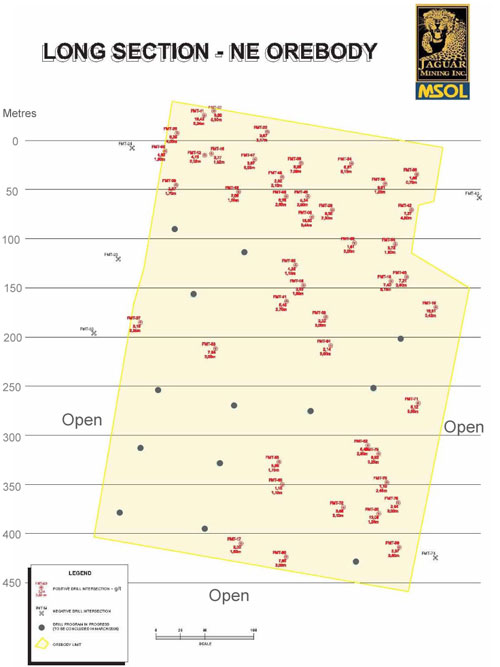

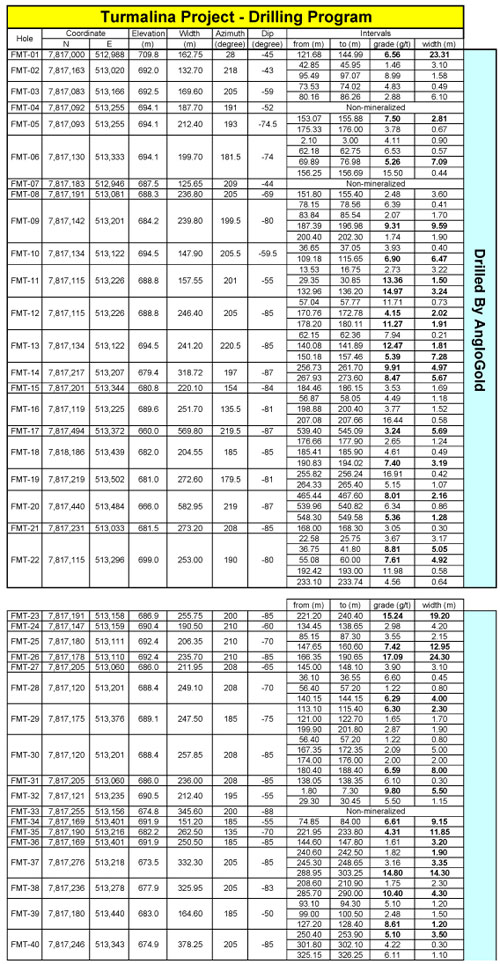

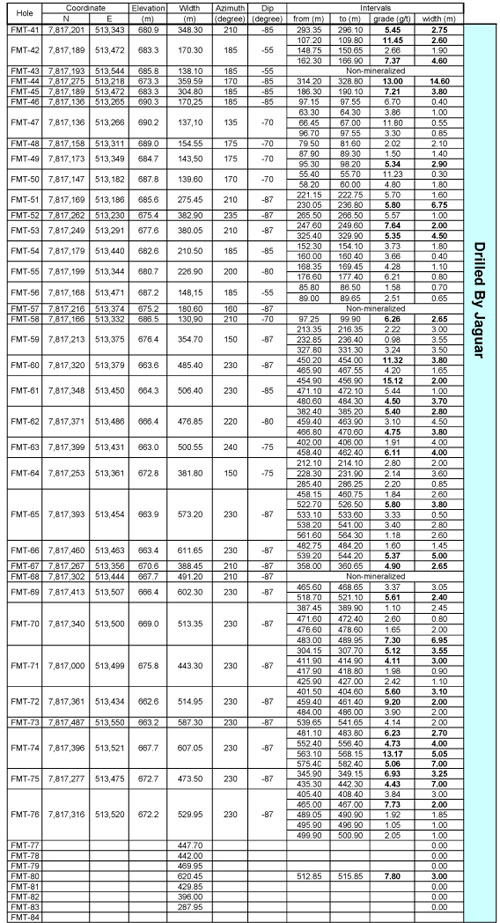

The results represent 32 holes of a 39-hole program and include 13.17g/t over 5.05m, 7.30g/t over 6.95m, 11.32g/t over 3.80m, 5.8g/t over 6.75m, and 5.35g/t over 4.5m. Only two holes contained no significant mineralization and 30 holes contained economic grades and widths, demonstrating good consistency and continuity across a large area of the orebody. Some of the best values occurred in the deepest part of the program on the Main Zone, confirming the potential for future exploration success and additional reserves. The remaining seven holes of this program will be completed in March.

The drill hole data and views are available at: http://www.jaguarmining.com/s/PressReleases.asp?ReportID=129306#map

The majority of the 32 holes focused on adding reserves and resources in the Main and North-east Zones, between the 350m and 500m levels. The remainder focused above the 350m level in the area of the existing mine plan. The Main Zone is 200m to 250m long, dips at 55º to 60º and ranges between 2m and 30m wide, with an average width of 8m. The North-east Zone is about 200m long, dips at 55º to 60º and ranges between 1m and 12m wide, with an average width of 3m. The two zones are only 50m to 100m apart, which is technically and economically attractive.

Turmalina will begin production in Q4 2006 at a capital cost of US$19.4 million and with an initial design capacity of 60,000 oz per year and cash operating costs of US$176/oz. The reserves, capital and cash costs assume a gold price of US$375/oz and an exchange rate of R$2.75/US$. The mine has 3.9km of existing underground ramp development and is 120km north-west of the major industrial city of Belo Horizonte, in the Iron Quadrangle greenstone belt.

The exploration results were audited by Ivan C. Machado, M.Sc., P.E., P.Eng., Principal of Salt Lake City based TechnoMine Services LLC. Mr. Machado serves as Jaguar's Qualified Person in accordance with NI 43-101. SGS Laboratories of Betim, Minas Gerais are providing independent sample preparation and assay services, using standard industry practices. The high cut-off was 30 g/t and the low cut-off was 2 g/t.

Mr. Graham Clow, P.Eng. and Mr. Wayne Valliant, P.Geo. of Roscoe Postle Associates Inc., both of whom are certified as a Qualified Person under NI 43-101, wrote the NI 43-101 report for the Turmalina Project.

Active Growth and Development Program

Jaguar produces gold in the Iron Quadrangle region of Brazil. Underground operations are projected to make up 75% of Jaguar's production profile of 235,000 oz/year by 2008. Using its experience and strong local relationships, Jaguar continues to acquire quality gold resources from senior mining companies and is preparing feasibility studies targeting the conversion of the acquired resources to reserves. It controls 62,500 acres of gold concessions, which is the second largest gold property portfolio in the district, and continues to aggressively explore its assets in Brazil's most prolific gold region. Jaguar has 33,731,786 common shares outstanding.

For further information, please contact Daniel Titcomb, President on (603) 224-4800 or Robert Jackson, EVP, Corporate Development on (416) 725-4343.

This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Such statements are only predictions, and the Company's actual financial conditions and results of operations could differ materially from those that may be contemplated by these forward looking statements and the assumptions upon which they are based as a result of those risks and uncertainties. For a discussion of important factors affecting the Company, see the "DESCRIPTION OF THE COMPANY'S BUSINESS" and in particular the subsection entitled "Risk Factors" in the Company's Annual Information Statement for the year ended December 31, 2004 filed on SEDAR and available at http://www.sedar.com. Jaguar's securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered, sold or resold in the United States or to a U.S. person absent registration or an applicable exemption from the registration requirements.